In the age of electronics one of the fastest growing markets is the 4x currency trading market. Volume in this arena is higher than any other market in the world. With the increase in international trade it is currently estimated that over $4 trillion dollars worth of currencies exchange hands each day. The high level of liquidity in the market means that there are always buyers and sellers willing to trade. The level of risk is high in the currency market. Leverage is where a large portion of traders get their trading capital. Only a small percentage of the funds traded are needed to begin. This can cause excessive profits as well as excessive loses depending on trade outcomes.

Making money by trading in the currencies market is the same as it is with the equities market or the commodities market. The goal is to buy at a low price and later sell at a greater value. If the currency is currently trading at a higher price and expected to drop, sell it now with the objective of buying it back later at a lower price. Obviously, the difference between the two prices is the profit. Currencies trade in pairs. The most widely traded pairs are the U.S.dollar and the euro, the U.S. dollar and the Japanese yen, the British pound and the U.S. dollar and the dollar and the Swiss franc.

There are all types of participants in the 4x currency trading market. The top trading level is that of the inter-bank market. This group consists of the largest investment banks. They have access to the best execution prices in the market. The reason for this is that they trade huge volumes of currencies daily. Prices for a specific currency will differ at different levels of trading as well as different locations. These differences are generally not large though. The banks primary objective is to trade for themselves in a profitable way, although they do trade for their customers also. They are over 50% of the daily volume.

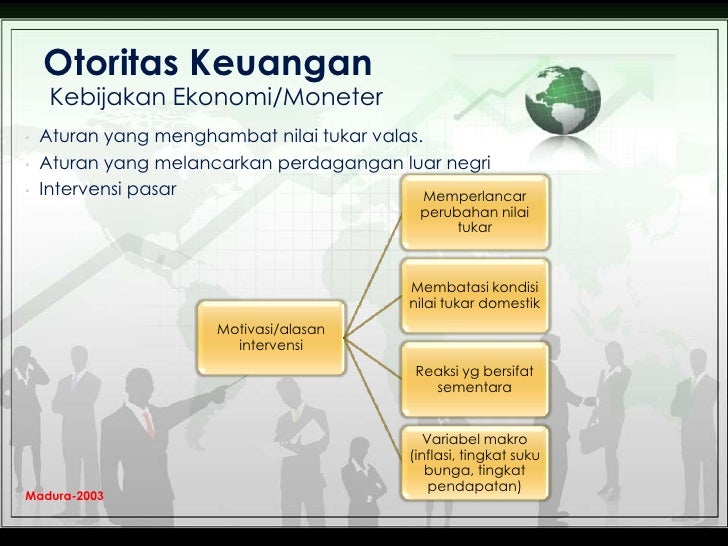

A smaller group of participants in the 4x currency trading market is the central banks of countries globally. They want to maintain stability of their monetary systems. They do this by trying to control interest rates, inflation and money supply.

Individual investors who want to participate want to participate in this market may decide to do so using a hedge fund. Hedge funds are a growing group in currency trading. They are funds with wide investment guidelines that includes speculation.

Making money in the currency market is difficult. There are many factors that cause prices to move. Factors like political stability within a country move prices. Economic stability is another part of the picture. This includes levels of budget and trade deficits or surpluses. The employment level is another important thing to look at.

Surviving as a trader in the currency markets is difficult. There are so many factors that need to be considered in decision making. Markets trade 24 hours a day, 5 days a week.

Becoming a winner in the 4x currency trading market is a complicated task. Having a solid understanding of what factors move prices and having the courage to act on that understanding can help you become a winner.