Currency Trading Tips In the dynamic realm of financial markets, currency trading stands as a gateway to unrivaled opportunities. As investors navigate the intricate pathways of global currencies, a strategic approach becomes imperative. Here, we delve into a compendium of currency trading tips, illuminating the path for those seeking mastery in the art of foreign exchange.

Technical Analysis Mastery: Decoding Market Signals

At the heart of astute currency trading lies the mastery of technical analysis. Chart patterns, candlestick formations, and various indicators become the palette for traders. Decoding market signals through technical analysis unveils potential entry and exit points, adding precision to trading decisions.

The Nuances of Fundamental Analysis: Unveiling Market Forces

Beyond charts and patterns, delve into the nuances of fundamental analysis. Understand the economic factors shaping currency values. Economic indicators, interest rates, and geopolitical events are the driving forces deciphered through fundamental analysis in the world of currency trading.

Risk Management Prudence: Safeguarding Capital

In the volatile landscape of currency trading, risk management emerges as a beacon of prudence. Establish risk tolerance levels, set stop-loss orders, and diversify portfolios to safeguard capital. The art of preserving capital is as crucial as the pursuit of profits in the realm of financial markets.

The Prowess of Algorithmic Trading

Embrace the prowess of algorithmic trading to execute strategies with precision. Automated systems, guided by predefined algorithms, navigate the complexities of currency trading. This technologically-driven approach adds efficiency and discipline to trading practices.

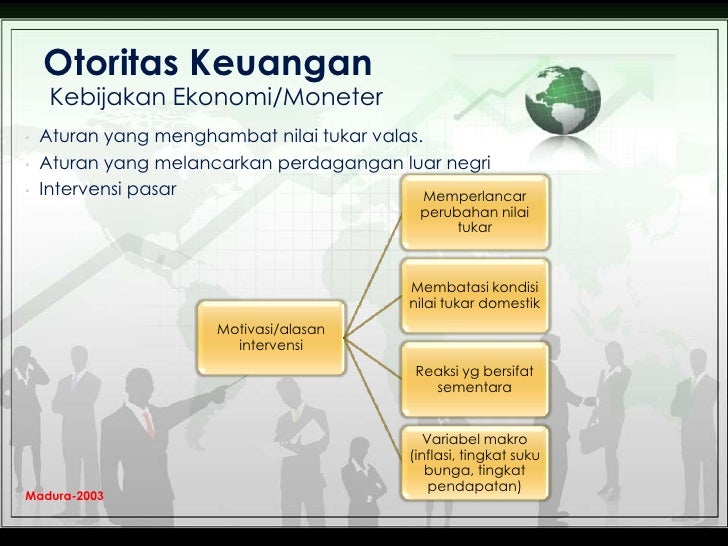

The Impact of Central Bank Policies: Navigating Monetary Trends

Central banks wield immense influence in currency trading. Stay attuned to their policies and pronouncements. Monetary policy decisions, interest rate changes, and economic outlooks shape currency values. Navigating the terrain of central bank policies is pivotal for informed trading decisions.

The Role of Leverage: A Double-Edged Sword

While leverage amplifies trading potential, it’s a double-edged sword. Exercise caution and employ leverage judiciously in currency trading. It magnifies gains but also escalates risks. The art lies in finding the delicate balance that aligns with individual risk tolerance.

The Advent of Cryptocurrency Trading

Enter the realm of decentralized currencies with cryptocurrency trading. Beyond traditional fiat currencies, cryptocurrencies present a new frontier. Bitcoin, Ethereum, and an array of altcoins offer diversification opportunities for traders venturing into the evolving landscape of digital assets.

The Psychology of Trading: Mastering Emotional Intelligence

The psychology of trading is as intricate as market dynamics. Mastering emotional intelligence is paramount. Greed and fear can cloud judgment. Cultivate discipline, resilience, and a rational mindset to navigate the psychological challenges inherent in currency trading.

Currency Correlations: Understanding Interconnected Markets

In the interconnected world of finance, grasp the concept of currency correlations. Understand how different currency pairs move in relation to one another. This awareness aids in risk management and strategic decision-making in the multifaceted arena of currency trading.

The Dynamics of Carry Trade: Riding Interest Rate Differentials

Carry trade involves capitalizing on interest rate differentials between currencies. Investors borrow in currencies with low-interest rates and invest in those offering higher rates. This strategy in currency trading leverages the financial nuances of global interest rates.

The Strategic Use of Options Trading

Elevate your toolkit with the strategic use of options trading in the currency market. Options provide flexibility and risk management. Whether as a hedge or a speculative tool, integrating options into your currency trading strategy adds a layer of sophistication.

Pattern Recognition Techniques: Unmasking Market Trends

Pattern recognition techniques empower traders to unmask market trends. Triangles, flags, and head-and-shoulders patterns are the visual cues of price movements. Proficiency in recognizing patterns enhances predictive capabilities in the dynamic landscape of currency trading.

The Significance of Political Events: Gauging Impact on Currencies

Political events wield a profound impact on currency trading. Elections, geopolitical tensions, and policy changes can trigger volatility. Stay vigilant to political developments globally, as they have a direct bearing on currency values and market sentiment.

The Art of Scalping: Profiting from Short-Term Movements

Scalping is an art form in the realm of currency trading. Profiting from short-term price movements, scalpers execute multiple trades in a day. Swift decision-making and technical analysis proficiency are the hallmarks of successful scalping strategies.

The Evolution of Mobile Trading Apps

Seamless execution and real-time access are facilitated by the evolution of mobile trading apps. In the fast-paced world of currency trading, these apps empower traders to monitor, analyze, and execute trades on the go. Embrace the mobility offered by cutting-edge technology.

The Wisdom of Long-Term Investing

Amidst the flurry of short-term strategies, appreciate the wisdom of long-term investing in currency trading. Fundamental strengths, economic trends, and macroeconomic factors play a pivotal role in the success of long-term positions. Patience and strategic foresight distinguish the long-term investor.

The Subtleties of Technical Indicators: A Trader’s Compass

Technical indicators serve as a trader’s compass in the tumultuous seas of currency trading. From Moving Averages to Relative Strength Index (RSI), these tools offer insights into market trends and potential turning points. Mastery of technical indicators refines entry and exit decisions.

The Global Impact of Economic Calendars

Economic calendars are invaluable resources in currency trading. Stay informed about scheduled economic releases and events. Employment reports, GDP figures, and central bank announcements create ripples in the market, presenting trading opportunities for those tuned into economic calendars.

The Unseen Forces of Market Sentiment

Market sentiment is an unseen force shaping currency movements. Gauge sentiment through various indicators, including trader positioning and news sentiment. Understanding the prevailing sentiment adds a qualitative dimension to the quantitative analysis in currency trading.

Conclusion: Navigating the Fluid Landscape of Currency Trading

In the fluid landscape of currency trading, these tips serve as navigational beacons for both novices and seasoned traders. From mastering technical analysis to embracing the subtleties of market sentiment, each element contributes to a comprehensive strategy. As investors embark on the journey of currency trading, may these insights illuminate the path to informed decision-making and financial success.